What you need to know & how to measure

Understanding how to measure e-commerce is a very important aspect of business development when selling goods online. Using the correct metrics is essential when trying to scale up an e-commerce business quickly or if you’re trying to prove a business to investors. This post will explain the key terminology and acronyms used in e-commerce and if you haven’t done so already, we would strongly recommend reading our digital marketing metrics that everyone should know guide first. Ecommerce focuses specifically on transaction-related metrics, many of which require an understanding of digital media but they are also part of tracking sales and revenue growth.

The online retail formula is pretty simple and describes the ratio of your Customer Acquisition Cost (CAC) to your Customer Lifetime Value (LTV). At its simplest, you want your formula to look like this:

Keep your Customer Acquisition Cost (CAC) below your Customer Lifetime Value (LTV)

The above equation is basic retail maths: you want to pay less for getting your customers than they spend with you. The difficult part is breaking the formula down and using the insights you gain in an actionable way so that you have healthy margins and profit.

First, let’s discuss why you should care about this formula, then we’ll break the formula down to examine the parts.

The online retail formula isn’t just a matter of figuring out if your CAC is lower than your LTV. The difference between your CAC and LTV will inform you of how you should adjust your marketing spending. The larger your business grows, the more important the retail formula becomes because you won’t always be able to use rough estimates. Once you start looking into how large and how quickly you can scale, you will want to know if, and by how much, you can increase your acquisition spending without going into the red.

On the opposite end of that, you might find out that your CAC is too much lower than your LTV, meaning you aren’t spending enough on your customers and there could be scope to improve your service.

Deeper Reasons for the Online Retail Formula

Solving this formula for your business gives you more than your CAC: LTV ratio. The variables you’ll need to define as you start piecing it together (Cost Per Visit, Gross Margin, Frequency, etc.) are valuable to be aware of as well.

The process of solving this formula will change the way you look at your business, leading to a more customer-centric model for a customer-centric market.

There are five Key Performance Indicators (KPIs) successful e-commerce companies look at to determine CAC and LTV:

- Cost Per Visit (CPV)

- Conversion Rate (CR)

- Average Order Value (AOV)

- Average Purchase Frequency (F)

- Gross Margin (GM)

How to Find Your Customer Acquisition Cost (CAC)

Your CAC is the total average cost to acquire and keep a customer for your business.

Find your customer acquisition cost by dividing your Cost Per Visit (CPV) by your Conversion Rate (CR). (In this formula, we’re defining conversion as the move from visitor to the customer).

CAC = CPV / CR

How to find your Cost Per Visit (CPV)

CPV = Total Marketing Costs (acquisition and retention) / Volume of Visits

How to find your Conversion Rate (CR)

CR = Total Number of Customers / Total Number of Visitors

One thing to make very clear here about finding your CPV: retention marketing is part of your total marketing costs. When finding your CPV, be sure you’re calculating the total cost of both acquiring your customers and of keeping them around to fulfil their customer lifetime value.

Example:

Let’s say it costs you an average of £0.10 per visit and you generally convert 3% of your visitors.

0.1 (CPV) / 0.03 (CR) = 3.333

Your CAC is £3.33 per customer.

How to Find Your Customer Lifetime Value (LTV)

Your customer lifetime value is the total value of a customer’s interactions with your brand.

Find your customer lifetime value by multiplying together your average order value (AOV); average purchase frequency rate (F); and gross margin (GM).

LTV = AOV * F * GM

How to find your Average Order Value (AOV):

AOV = Total Revenue / Total Number of Orders

How to find your Average Purchase Frequency (F):

F = Total Number of Orders / Total Number of Unique Customers

How to find your Gross Margin (GM)

GM = (Total Sales Revenue – Cost of Goods Sold) / Total Sales Revenue

Cost of Goods Sold (COGS) = Beginning Inventory (the inventory left from last year) + Additional Inventory Cost (purchased this year) – Ending Inventory (at the end of the year)

Example:

Let’s say you have an Average Order Value of £40, an Average Purchase Frequency of 3 and a Gross Margin of 50%:

40 (AOV) * 3 (F) * .5 = £60

Your LTV is £60 per customer.

Using the Online Retail Formula

In our first example, we found a CAC of £3.33 per customer. In our second, we found an LTV of £60 per customer.

Let’s plug those values into CAC < LTV:

3.33 < 60

Our CAC is less than our LTV! Does that mean we’ve succeeded? Yes. But no. The first and most important rule is to keep your CAC below your LTV but you don’t want the ratio to be too severe.

3.33 < 60 means our CAC:LTV ratio is nearly 1:20. While it’s better to have the ratio skewed in this direction, a finding this dramatic suggests you could have even greater success by spending more on your customers.

Applying the Formula Findings to Your Business

You found your KPIs. You did the formula. Now what?

If you went through the calculations and found out that your CAC: LTV ratio is perfect, then congratulations! If not, don’t panic. This is why we want to use the formula in the first place. Now that you’ve plugged in all the KPIs that make up the ratio, pick your weakest KPI and improve it. Focus on the “low-hanging fruit.” Rather than trying to make your above-average areas perfect, find your worst performing areas and focus on making them good.

Is the problem that your CAC is too high, or is your LTV just too low? Find the average for your industry and compare those metrics to your company’s. If the problem is with your CAC, look into the KPIs you used to find it:

CAC = CPV / CR

Is the problem that your Cost Per Visit is too high, or is your Conversion Rate too low? With the information you found while calculating your CAC: LTV ratio, you now know which area to focus on.

It’s possible to easily track the progress of each of these KPIs as you work on them. Using our collection of industry data tools, we can use real-time data updates to keep all important KPIs up-to-date and available to our clients in an easy to read format. For more information about reporting, data and analytics. Please take a look at our website analytics page.

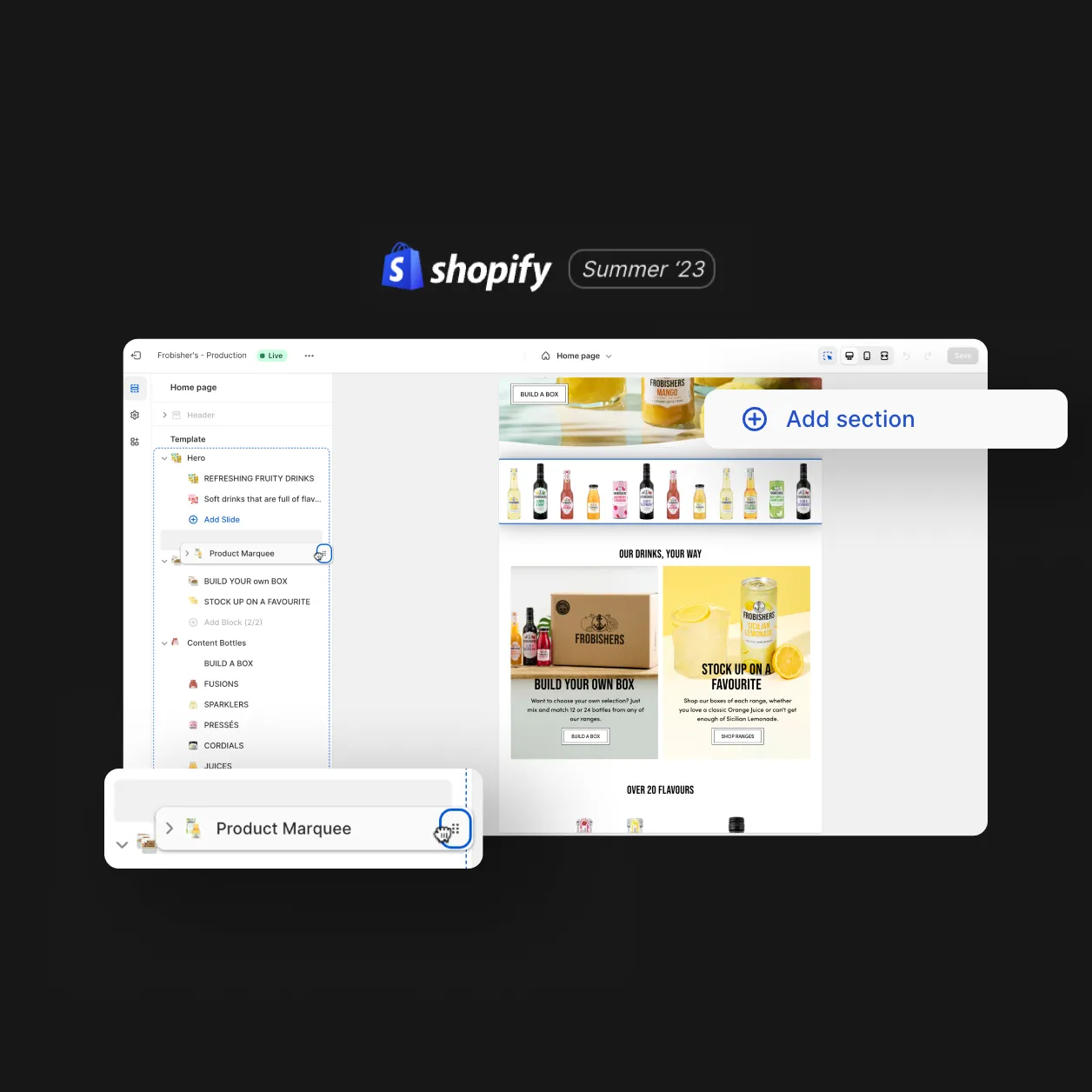

Design

Inspiring behaviour change through visual experiences. Our digital design services ensure instant clarity and visuals that cut-through in a cluttered market.