Did we really need to make a whole blog post about a simple calculation?

Spoiler: it’s actually far more complex than you might imagine. With several different ways to calculate your churn rate, each with potential reporting flaws, it’s important that you select the right one. After all, it’s a vital statistic for DTC brands – whether you’re scaling fast or experiencing steady growth.

In this post, we demystify churn rate and help you to find the right calculation for your business.

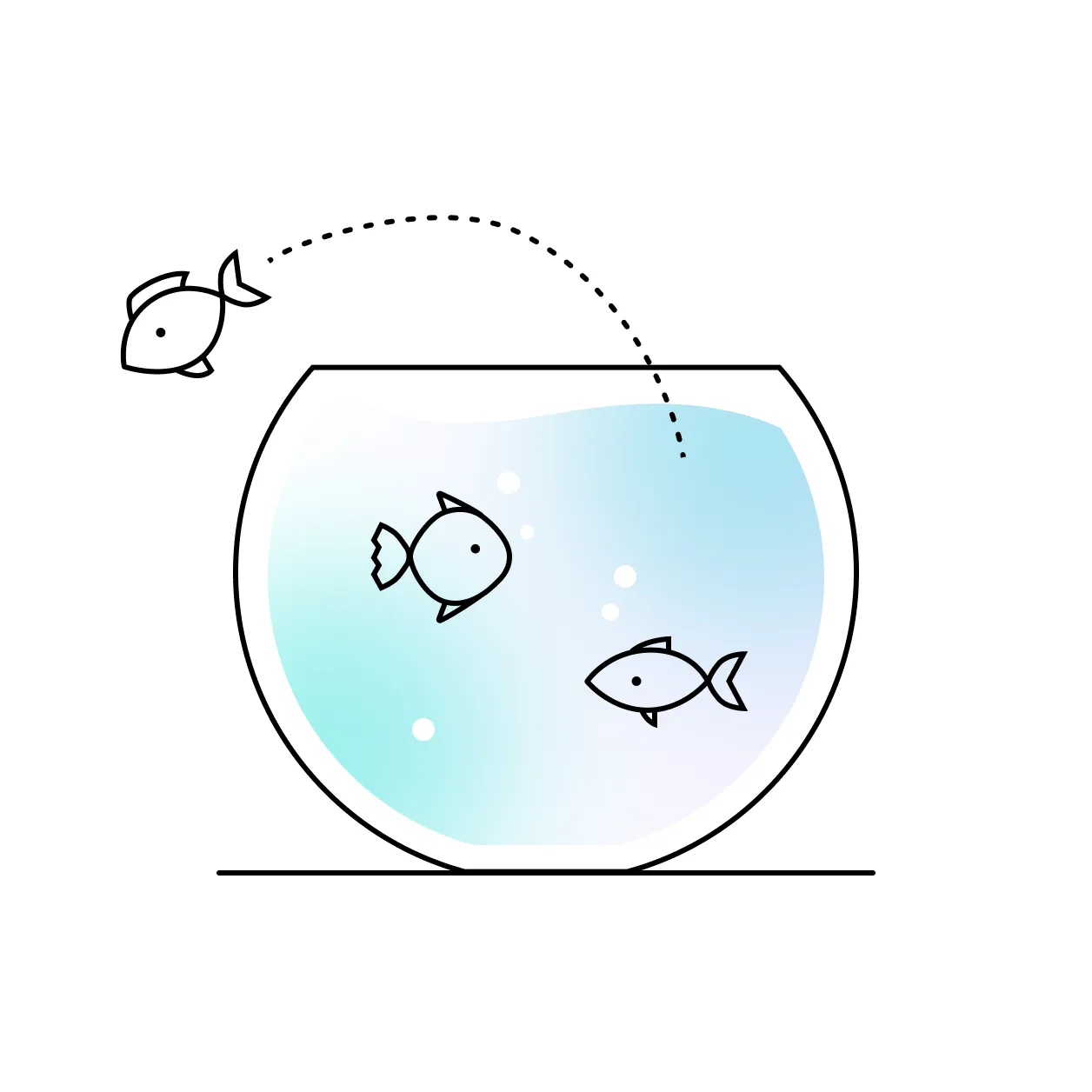

What is churn rate?

The concept is pretty simple, prevent existing customers jumping out of your pool and into a competitors.

Your churn rate, sometimes referred to as attrition rate, is the percentage of customers that leave your service/subscription during a given period. For the purposes of this article, we’re basing our calculations on a 30 day rolling subscription business.

When you understand your churn rate, you can start to analyse and improve on the stickiness of your business in order to safeguard your bottom line. You can also use this number to identify changes that may have had an adverse effect on retention, forecast performance and lots more.

The opposite of churn is retention. When you retain more customers, your churn decreases.

However, the calculations vary and it’s really easy to fall down a rabbit hole when trying to get to grips with the right method. And when you do that, you no longer focus on growth and instead find yourself in a web of your own making.

How to calculate churn rate

At first glance, most people plump for a formula that looks a bit like this:

Number of churned customers / total number of customers

But how are you defining these numbers? Because your definitions will impact your result significantly. For example, the total number of customers in one month could change drastically during those 30(ish) days based on new subscribers and cancellations. In fact, during this month-long time period you’ll actually have 3 customer categories:

- New sign ups

- People that signed up a month prior

- Newly churned customers.

How do we account for these different categories without skewing the churn result? As well as discrepancies between your day 1 to day 30 customer number, you also need to factor in the fact that new customers usually churn at a higher rate than those with a longer LTV.

The actual point where you allocate churn status also has two definitions. Do you count the moment of churn as when the subscription ends and renewal doesn’t take place OR at the moment of cancellation? After all, they’re paid up for the month, so you might not want to count the churn until the cancellation takes place, as you still have a chance to convince them to stay!

Choose your churn rate calculation

As Shopify Partners, we’re always eager to learn from the source. Steve Noble at Shopify discusses four ways to think about churn rate. You can read the full article here, but we’ve distilled it into a handy guide below so you can easily pick your method.

For the minimalist

Sometimes simple is just better. It helps to unify everybody in your organisation and gives you the ability to focus on other factors that’ll make the difference in terms of retention and growth. To opt for this calculation you simply need to:

- Pick a period

- Keep that period consistent e.g. M-o-M

- Divide the total number of churned customers by the number of customers you had on day 1 of this period.

But remember, with simplicity comes a few caveats. This method doesn’t account for significant growth within the period. If your customer number shoots up, your churn rate will go down, even if more customers churn than the previous month. This is especially challenging for start-ups experiencing high levels of growth as it’ll distort results.

A quick example…

You’re trying to calculate your churn rate for September and October.

- In September you started with 2,000 customers, you lost 5% of them (100). You then gained 1,000 new customers and lost 2.5% of them (25).

- In October you start with 2,875 customers. You lose 5% again, gain another 1,000 and again lose 2.5%

- The churn rate for September is 6.25% but the churn rate for October would be 5.87%. That’s a big difference considering everything, percentage wise, happened at the same rate. You’ll be reporting on an improving churn rate, when actually it’s your growth rate that’s improved. So how do you address this?

For the fast growing minimalist

A quick-growth company might be tempted to use this slightly altered equation to factor in fast growth. Everything here is the same, apart from the denominator takes an average of the number of customers within that window.

This effectively settles the data down to account for the leap in growth. However this doesn’t work when you take different time periods. You’d need to always work with the same frame of time, as when you apply the equation daily or quarterly, you get different results. This is only a good solution if you’re always working with the same time periods OR you’re happy to have skewed results depending on when you’re reporting. You could always back it up with another method.

For the risk-taking fortune teller

There are times to take risks (exciting business opportunities) and times to tell the future (see: Mystic Meg) but together as a business metric? Probably not. This is one step away from working out but doesn’t quite hit the nail on the head.

This solution is trying to determine a weighted average, so that the result can be multiplied by customers to provide a churn rate prediction on any given day. To do this, it is based on a 30 day window, i.e. how many active customers on day 1 are still active one month later. If you have 2,000 subscribers on the 1st of September, you can predict how many of those will have churned by the 1st of the following month. You then divide that by the total number of customers in month 1.

But you need two months worth of data to work out the churn rate for a single month. To calculate it for this month, you need to wait until the end of the next month. Obviously we’re now not keeping up with current results and it begins to slow things down.

For the Shopify heads

As self-proclaimed Shopify heads, this seems to be the most accurate way to calculate churn rate as it factors in both growth and differing time periods.

This is basically an adapted version of the fast growing minimalist option. While it’s a little more complicated, it’ll likely work more accurately for your business. In this calculation, we divide the number churned by the average of your customer count between days 1 and 30 (or whatever the last day is). This average is taken day-by-day rather than day 1 and day 30 so more accurately reflects your customer count and fluctuations thereof.

This works for:

✔️ High growth periods

✔️ Different time windows

✔️ Up-to-date results

As we mentioned at the top, there are always going to be factors you can’t account for e.g. new customer churn being higher than long-term customers and variations in subscriptions sizes/offerings. You could always segment this data, however, to have a more accurate view of what’s going on across your customer base. We would always recommend this practice, not only does it give you more accurate data but it empowers you to make the decisions you need to make to encourage great growth.

To learn more about how we can impact your churn rate, and nurture retention, get in touch with our growth marketing team.

Design

Inspiring behaviour change through visual experiences. Our digital design services ensure instant clarity and visuals that cut-through in a cluttered market.