For tech companies and ad sellers alike, 2021 was going to be a hard act to follow. Our covid enforced digital dependency which drove the online advertising boom has waned. According to eMarketer US consumer spending grew by +38% versus a +21% average in the five years previous.

We are now in what feels like a digital comedown and the ad industry is being shaken up by a number of factors. One is the rise of ad-blocking software, which is used by an estimated 600 million people worldwide. This has led to a decline in ad revenues for publishers and platforms alike. Another factor is the increasing use of ad blockers by mobile users. This has had a particularly acute effect on Google, which relies heavily on mobile advertising. In addition, there is growing concern about the use of personal data by ad-tech firms. This has led to calls for greater regulation of the industry and has resulted in some companies withdrawing from the market altogether. Finally, there is the growing popularity of ad-free platforms such as Netflix and Amazon Prime. This is eating into the revenues of traditional ad-supported platforms such as television and print media.

Sliding tech share prices

This has hit smaller social platforms such as Snap and Twitter harder with the former reporting +13% YOY growth in July 2022 – its most sluggish period ever. This growth would be enviable to many large businesses but was enough to spook investors and the company’s share price fell by -40%. The following day Twitter, another advertising depend advertiser reported a fall in its annual revenue in the 3 months to June compared to last year. Meanwhile, Google reported quarterly growth of +13% (down from +63% YOY) and Facebook’s revenue fell for the first time by -1%.

Continued potential for growth

The online-ad industry is facing some challenges, but it is still growing rapidly. This year, eMarketer estimates that global spending on online advertising will reach $334 billion, an increase of 58% from 2020. This growth is being driven by the continued shift of consumer activity online, as well as by the increasing use of mobile devices. In addition, the industry is benefiting from the ongoing shift of ad spending from traditional media to digital channels. This trend is expected to continue in the years ahead, as advertisers seek to reach consumers where they are spending more and more of their time.

A legimitate challenger?

As TikTok continues to grow in popularity, it is increasingly becoming a threat to the duopoly of Facebook and Google. TikTok has already surpassed both Facebook and YouTube in terms of monthly active users in several key markets, including India and China. And while TikTok is still far behind Facebook and Google when it comes to overall global reach, the app is quickly closing the gap.

In addition to its massive user base, TikTok also has a number of other advantages that make it a serious competitor to Facebook and Google. For one, TikTok is much more than just a video-sharing platform; it’s also a social network, which gives it a leg up on YouTube (which is owned by Google). TikTok also has a very strong presence in emerging markets, which are key growth areas for Facebook and Google.

Lastly, TikTok is owned by ByteDance, a Chinese company that is not subject to the same regulatory scrutiny as Facebook and Google. This gives TikTok an advantage when it comes to innovation and data privacy.

As TikTok continues to grow in popularity and become a more serious threat to Facebook and Google, it will be interesting to see how the two companies respond. Will they try to copy TikTok’s success? Or will they double down on their existing platforms? Only time will tell.

Upending the status quo?

The duopoly is not about to crumble. But it faces real challenges.

User growth at both firms has stalled in America. Facebook had 184m, daily users, in America in the first quarter of 2019, according to eMarketer, a research firm. By the same stage this year that had fallen to 182m. At Google, the number of American users of its YouTube video service grew by just 1% in 2019, according to another research firm, Comscore. And both firms are having to spend more to keep the users they have. In the first quarter Facebook’s “cost of revenue”, which includes the price of hosting all that stuff people post, rose by 50% year-on-year, to $9.5bn. Google’s “traffic-acquisition costs”, the fees it pays to partners such as Apple and Verizon, who feature its services on their devices, rose by 23%, to $6.4bn.

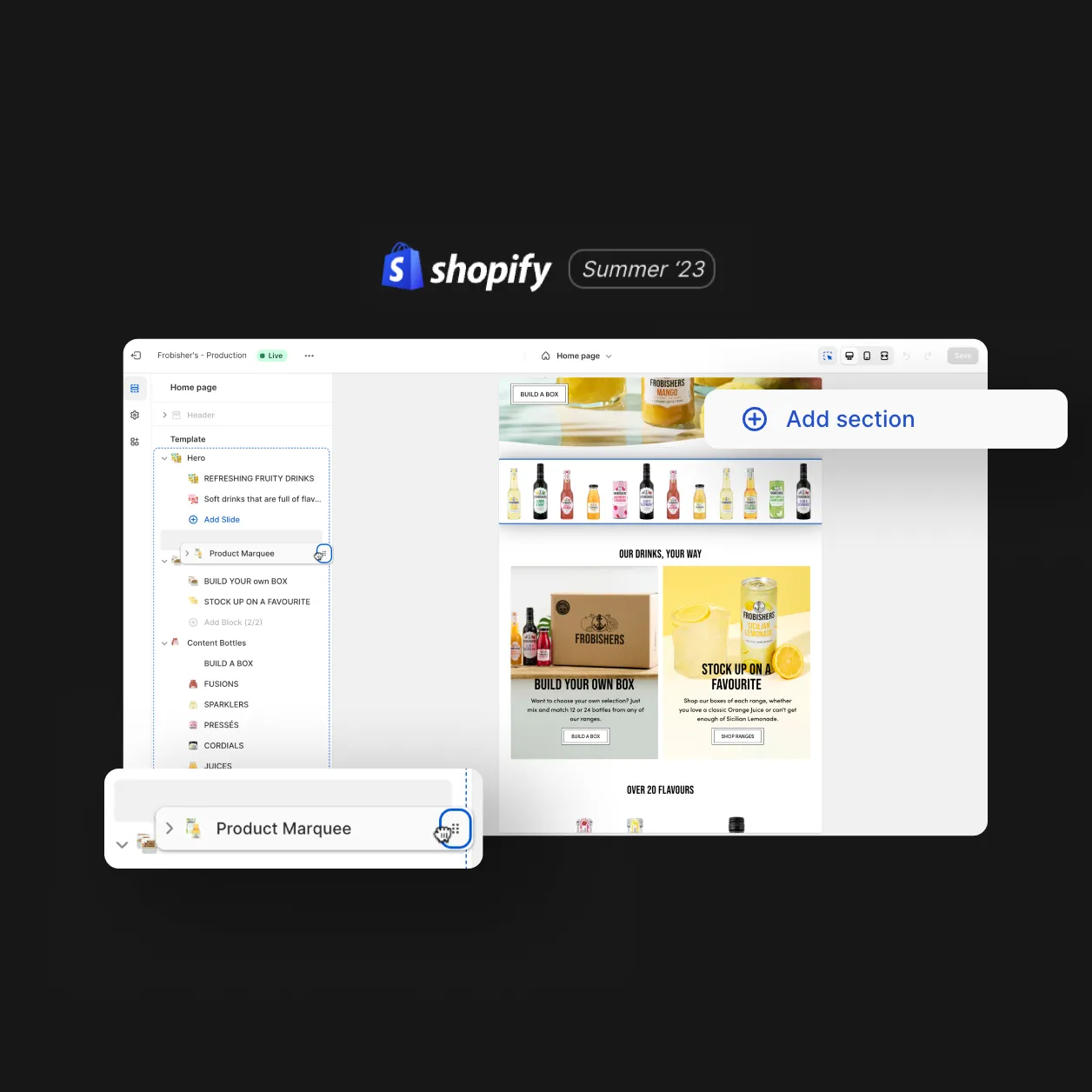

Design

Inspiring behaviour change through visual experiences. Our digital design services ensure instant clarity and visuals that cut-through in a cluttered market.